Your Money At Work

Professional money management for your workplace retirement account

"How do I know if my investment choices match my tolerance for risk?"

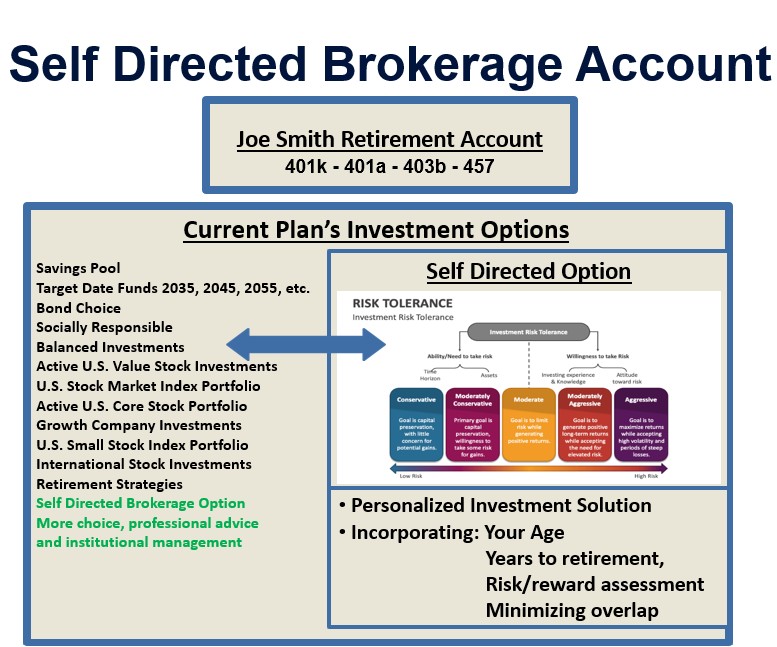

"What are my investment options currently?"

"I haven't thought about my allocation since I made my original selections...how long ago was that?"

Sound Familiar?

"I asked a co-worker how they invested their account, then I chose something similar."

"I wish someone would help me with this retirement account."

"I'm not sure what funds I'm currently invested in."

You're still working...

Your workplace retirement account should be working too!

As a one of your employer benefits & services you can use NCFA’s On Plan Money Management™ Program to take your retirement plan assets that may be static or neglected and turn them into dynamically managed assets.

- Access professional money management while you are still employed – your assets stay in the plan.

- Know that your account is being analyzed and managed to navigate changing market conditions over time.

- Work with your financial professional to bring this core asset into your overall financial plan now.

Add professional money management to your workplace account today

If you are like many investors, your workplace retirement investment may be among your largest assets.

Are you giving this account the time and attention it deserves to help to protect it and seek growth over time?

Don’t wait until you retire to take control of how it’s invested.

Navigating Market Changes

The thing is: markets change, information changes…even the investment options available to you may change. How are you managing these factors in your workplace retirement account?