Protecting What Matters Most

Expert guidance on personal insurance and retirement solutions

What is Insurance?

Insurance is a financial safety net that protects you and your loved ones from unexpected events and financial hardship. It’s a contract between you and an insurance company where you pay regular premiums for guaranteed protection against specific risks.

Key Insurance Benefits:

- Financial security for your loved ones

- Protection against unexpected events

- Tax-advantaged wealth accumulation

- Guaranteed retirement income options

Personal Insurance & Retirement Solutions

Life Insurance

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

Annuities

- Fixed Annuities

- Variable Annuities

- Fixed Indexed Annuities

- Immediate Annuities

Investment Edge® Variable Annuity from Equitable

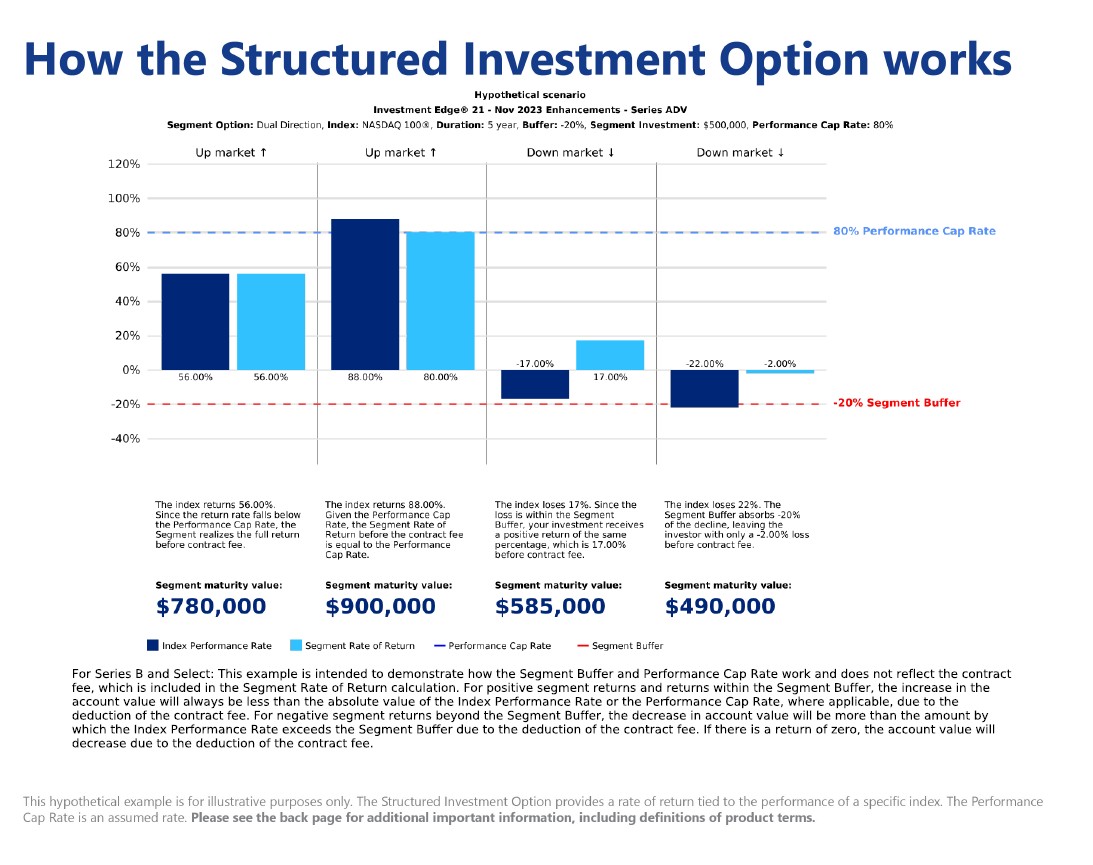

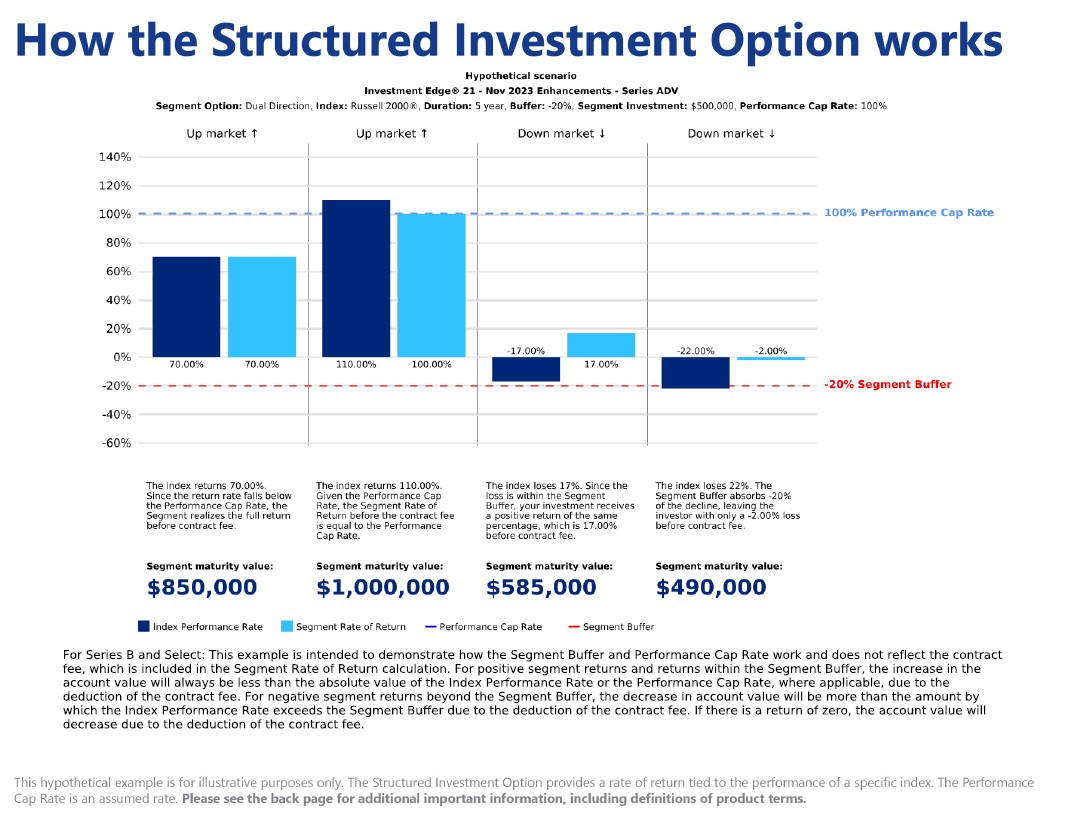

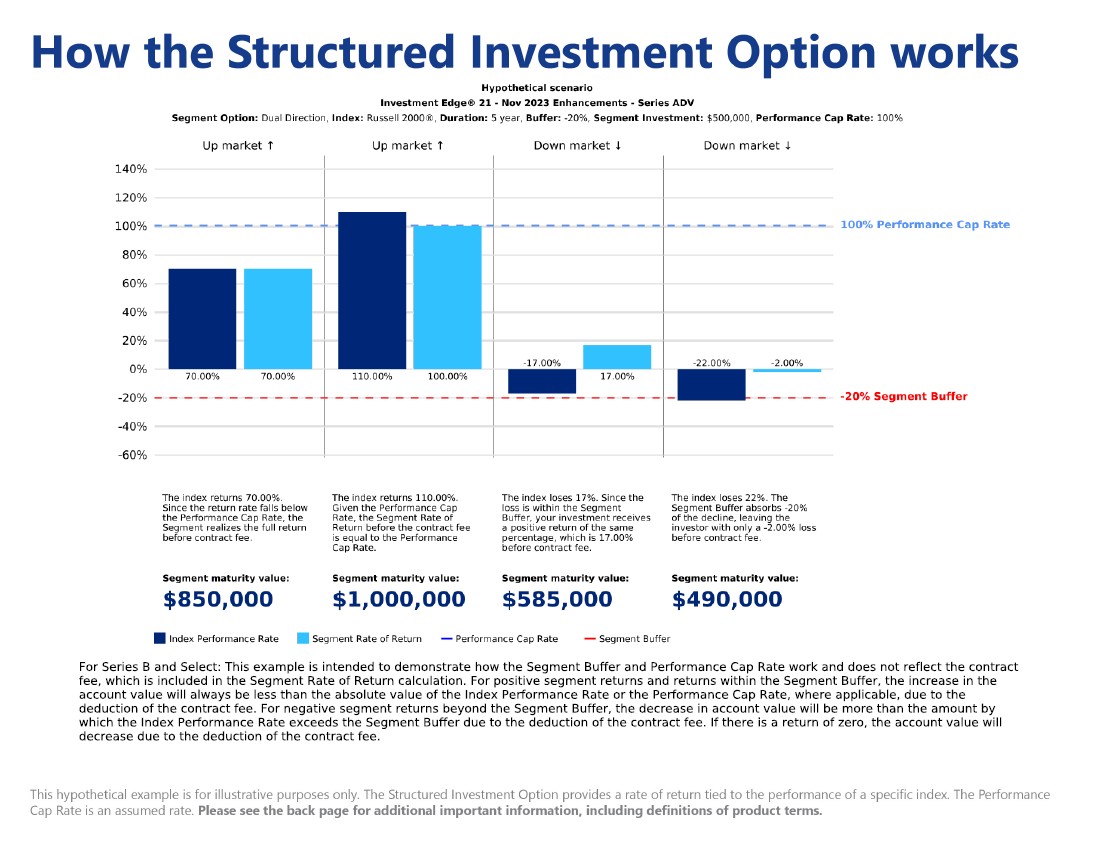

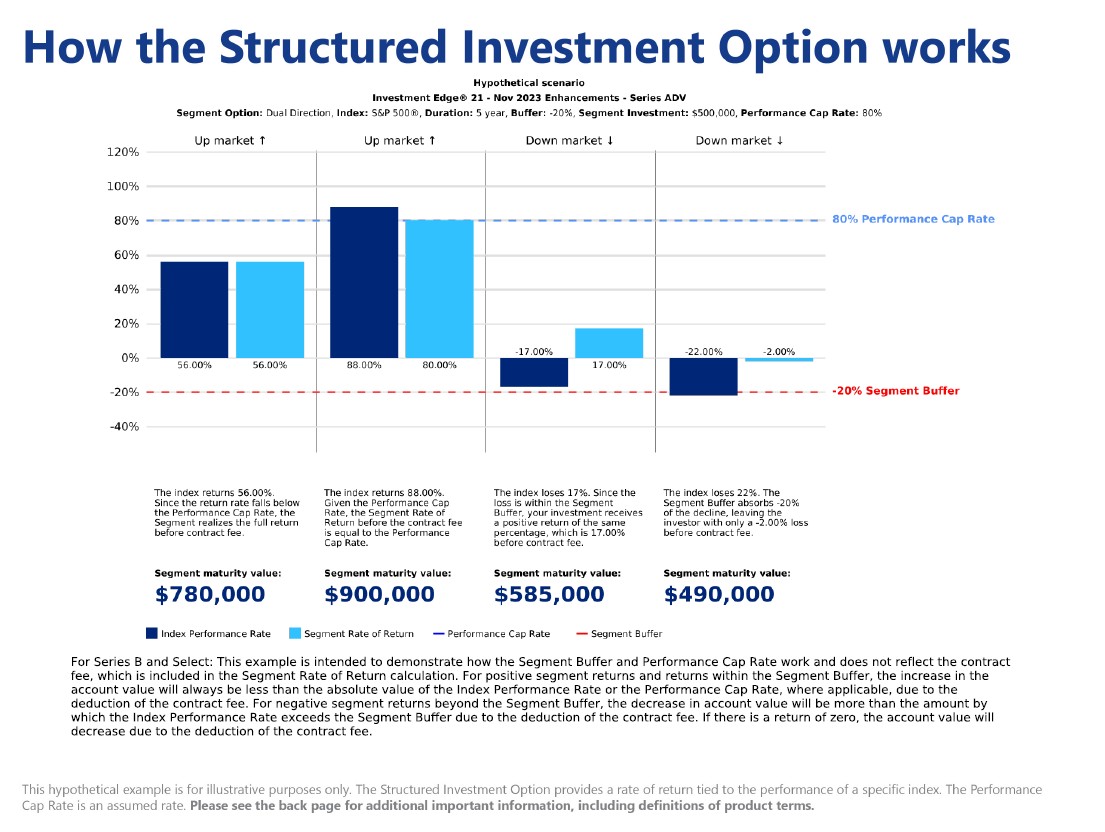

With Investment Edge® is an innovative variable annuity that helps create an investment portfolio with greater diversification, partial protection in the market and tax-deferred growth.

Features and benefits

Explore an innovative approach to investing

With Investment Edge®, you have access to more than 100 investment options from industry-leading investment managers, as well as Segments, which can lower overall investment cost, provide an opportunity for enhanced growth or add a level of protection from market volatility depending on the Segment you choose.

Go further with tax deferral

This will allow your contributions and earnings to compound and grow without having to pay taxes on your growth until later.

Add a level of downside protection

Help safeguard your portfolio from market volatility by choosing a level of downside protection to preserve your wealth in any market condition or enhance your growth potential.

The disclosure below applies to bank distribution entities. This material is for informational purposes only and does not constitute investment advice or a recommendation.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, THE BANK OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Investment Edge® Variable Annuity from Equitable

NASDAQ

Russell 2000

S&P 500

Disclosures: % of Times Returns Occurred Above the Segment Buffer — This row shows the percentage of times a rolling monthly index return occurred above -10% or -15%. Average Return — a simple average of a series of returns generated over the given period of time. Past performance is no guarantee of future results. Individuals cannot invest directly in an index. This data does not represent the performance of any specific investment. The Segment Rate of Return will differ from that of the performance shown above due to the Performance Cap Rate, fees and expenses. Segment Type — Comprises all Segment Options having the same index, Segment Duration and Segment Buffer. Each Segment Type has a corresponding Segment Type Holding Account Segment Buffer — The portion of any negative Index Performance Rate that the Segment Buffer absorbs on a Segment Maturity Date for a particular Segment. Any percentage decline in the Segment’s index performance rate in excess of the Segment Buffer will not be absorbed. Segment Duration — Period from Segment Start Date to Segment Maturity Date. Performance Cap Rate —The highest index performance rate that can be used to calculate the Segment Rate of Return. We set the Performance Cap Rate for each new Segment on the Segment Start Date. We reserve the right to set the Performance Cap Rate at any time prior to the Segment Start Date. The Performance Cap Rate may vary for each Segment. In addition, for any particular Segment, we may set a Performance Cap Rate applicable to allocations under new contracts that is different than the Performance Cap Rate applicable to allocations under existing contracts. The Performance Cap Rate is not an annual rate of return. Multiplier Rate: Declared rate that is set at Segment start date and fixed for segment duration. The Multiplier Rate determines how much of the Index Performance Rate is used to calculate the Segment Rate of Return on the Segment Maturity Date for the Enhanced Growth Segment. The multiplier rate will be declared on the same schedule as preannounced cap rates. Segment Interim Value — The value of your investment in a Segment prior to the Segment Maturity Date, and it may be lower than your original investment in the Segment even where the index is higher at the time of the withdrawal prior to maturity. A withdrawal from the Segment Interim Value may be lower than your Segment Investment and may be less than the amount you would have received had you held the investment until the Segment Maturity Date. In Investment Edge®, you can invest to accumulate value on a tax-deferred basis with access to Variable Investment Options, as well as Segments comprising the Structured Investment Option. The SIO permits the contract owner to invest in one or more Segments each of which provides returns tied to the performance of a securities index for a 1- or 5-year period. The partial protection feature, called the Segment Buffer, will absorb up to the first 40% of loss, depending on the level of protection selected. Please keep in mind that there is risk of substantial loss of principal because the investor agrees to absorb all losses that exceed the protection provided by the SIO at maturity. For the Growth Multiplier Segment, there is no Segment Buffer, investors absorb all of the loss when markets are down, so there is a risk of substantial loss. If you would like a guarantee of principal, Equitable Financial and Equitable America offer other variable annuity contracts with different fees, charges and features. If you take a withdrawal from, or transfer out of, a Segment before the Segment Maturity Date, we calculate the Segment Interim Value (SIV) for that Segment. The SIV may be less than the Segment Investment and may be less than the Segment Maturity Value would have been on the Segment Maturity Date. Any such withdrawal or transfer will reduce the Segment Investment and the reduction may be greater than the dollar amount of the withdrawal or transfer. Annuities contain certain restrictions and limitations. For costs and complete details contact a financial professional. The Investment Edge® variable annuity is a tax-deferred financial product designed to allow you to invest for growth potential and provide income for retirement or other long-term life goals. Amounts invested in annuity portfolios are subject to fluctuation and market risk, including loss of principal. There are fees and charges associated with a variable annuity contract, which include, but are not limited to, operations charges, sales and withdrawal charges and administrative fees. The withdrawal charge declines from 6% to 3% over five years for Investment Edge®. Earnings are taxable as ordinary income when distributed and may be subject to an additional 10% federal tax if withdrawn before age 59½. You can take withdrawals subject to ordinary income tax and the contract can be fully redeemed for the then-current account value net of applicable withdrawal charges. There are additional restrictions and limitations including age restrictions and the payout period being limited to specific time periods. Please see the prospectus for more information including Investment Edge® fees and charges. If you are purchasing an annuity contract to fund an Individual Retirement Annuity (IRA) or employer -sponsored retirement plan, you should be aware that such annuities do no provide tax-deferral benefits beyond those already provided by the Internal Revenue Code. Before purchasing one of these annuities, you should consider whether its features and benefits beyond tax deferral meet your needs and goals. You may also want to consider the relative features, benefits and costs of these annuities with any other investment that you may use in connection with your retirement plan or arrangement. This content is not a complete description of all material provisions of the variable annuity contract. There are certain contract limitations and restrictions associated with an Investment Edge® contract. For costs and complete details of coverage, speak to your financial professional/insurance licensed registered representative. Certain types of contracts, features and benefits may not be available in all jurisdictions. Equitable Financial and Equitable America offer other variable annuity contracts with different fees, charges and features. Not every contract is available through the same selling broker/dealer. This is not a complete description of Investment Edge®. Annuities are subject to certain restrictions and limitations. For costs and complete details, contact a financial professional. This content was prepared to support the promotion and marketing of Equitable Financial and Equitable America variable annuities. Equitable Financial and Equitable America, their distributors and their respective representatives do not provide tax, accounting or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local tax penalties. Please consult your own independent advisors as to any tax, accounting or legal statements made herein. When distributed outside of New York state by Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI & TN) through Equitable Advisors Financial Professionals whose business address is not in New York state, or when distributed by Equitable Distributors, LLC through financial professionals of unaffiliated broker/dealers when the solicitation state is not New York, Investment Edge® variable annuity is issued by Equitable Financial Life Insurance Company of America (Equitable America), an AZ stock company with an administrative office located in Charlotte, NC. When offered by Equitable Advisors Financial Professionals whose business address is in New York state or when distributed by Equitable Distributors, LLC through financial professionals of unaffiliated broker/dealers when the solicitation state is New York, Investment Edge® is issued by Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY). The obligations of Equitable Financial Life Insurance Company and Equitable Financial Life Insurance Company of America are backed solely by their own claims-paying abilities. Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY); Equitable Financial Life Insurance Company of America (Equitable America), an AZ stock company with an administrative office located in Charlotte, NC; and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI & TN). Contract Form #s: 2021BASE2-A-Z,2021BASE2-B-Z, 2021BASE1-A-Z, 2021BASE1-B-Z and any state variations. GE-6783486.1 IE (7/24)(Exp. 7/26)

Commission-Based vs. Fee-Only Insurance

Features | Commission-Based | Fee-Only |

|---|---|---|

Cost Structure | Built into premium costs | Transparent, flat fee |

Surrender Charges | Often high in early years | Usually none |

Mortality Fees | Mortality Fees | Generally lower |

Flexibility | May have restrictions | Usually more flexible |

Fee-Only Insurance Solutions Section

Our fee-only insurance solutions prioritize transparency and your best interests, eliminating conflicts of interest and hidden costs typically associated with commission-based products.

Key Insurance Options:

Low-Cost Term Life

- No surrender charges

- Level premiums

- Coverage from $100,000 to $5M+

No-Load Universal Life & No-Load Variable Universal Life

- Minimal expense charges

- No surrender fees

- Flexible premiums

- Tax-advantaged growth

Retirement Income Solutions

Fixed Index Annuities

- Market-linked growth potential with principal protection

- No market risk

- Tax-deferred growth

Income Annuities

- Guaranteed lifetime income streams

- Immediate or deferred payouts