Future-Proof Your 401(k): Scalable Retirement Solutions for Growing Businesses

NCFA, in partnership with Betterment, offers an innovative 401(k) platform designed to evolve with your company. Our solution provides small and mid-market businesses with affordable, adaptable retirement plans that simplify administration and enhance employee benefits.

Recognized by: Bankrate on 1.21.24 for 2024. Fee paid for logo use; G2 on 8.8.24 for reviews since 11.10.20. Some reviewers compensated.

The 401(k) built to keep up with your growth.

Put investment expertise behind your 401(k)

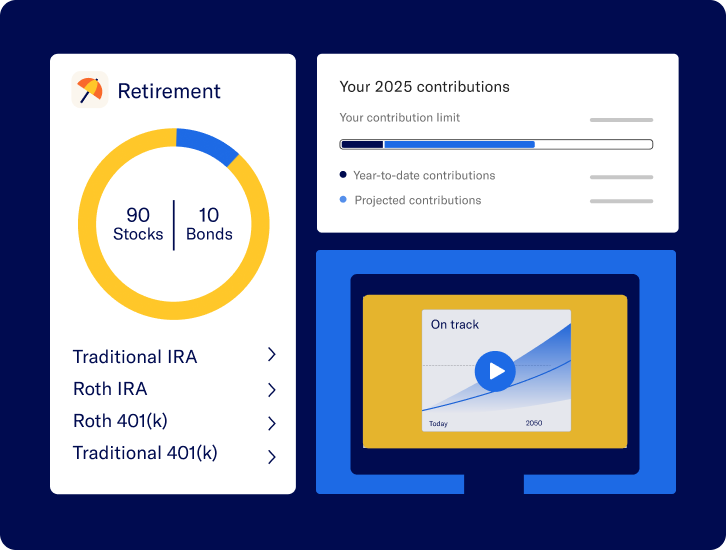

Leverage our proven track record to deliver a better retirement plan. Provide everything from expert-built, curated portfolios to customizable investment options, giving employees the flexibility to save on their terms.

Customize your plan design

Design a plan that fits your needs, from auto-escalation and auto-enrollment to eligibility requirements, vesting schedule, profit sharing—and much more.

Simplify plan administration

Monitor real-time plan metrics, create custom reports, and access participant-level data—all from your dashboard.

Leave compliance to the experts

Trade compliance complexity for certainty with our team of specialists who handle annual testing, calculate contributions, and prepare signature-ready Form 5500 to help your plan stay compliant.

Leverage a robust employee engagement program

Employees can access a wealth of educational resources, including videos, webinars, and articles to answer questions and help them level up their finances. We also engage employees with in-app retirement advice and customized emails covering a range of 401(k)-related topics.

Offer optional financial wellness benefits

Go beyond retirement with additional employee benefits like 529 Educational Savings and Financial Coaching.

Estimate your plan costs with our tax savings calculator.

You could earn up to $15,000 in tax credits over the first three years of your plan.

Dedicated service and expert operational support.

Ongoing support for plan sponsors

Get 401(k) administration help and answers from our Plan Support Team or a dedicated Client Success Manager whenever you need it.

Employee support team

Specialists are available via call, email, or chat to resolve the specific needs of employees.

average response time for phone and live chat

Based on internal metrics for the Employee Support Team.

An onboarding specialist by your side

Quickly set up your new or conversion plan with support from a dedicated onboarding specialist.

15% faster plan conversion onboarding with NCFA with our strategic partner Betterment compared to the industry average.

300+ payroll integrations.

Estimate your plan costs with our tax savings calculator.

We connect with your payroll to simplify plan administration, track employee eligibility, and automate away 401(k) hassle. See all our payroll integrations here.

All logos are trademarks of their respective companies.

Everything was easy. Setup. Payroll integration. Compliance. I was surprised at how easy a 401(k) could be.”

Daniel Reed, Founder of Whycan

This was a great decision for our small business. NCFA with our strategic partner Betterment integrates with our payroll service so it is easy to setup and manage. Our employees love having the retirement benefit and it makes our small business more attractive when hiring new employees."

NCFA with our strategic partner Betterment is easy to manage as a business owner, is good value for the money, connects to our payroll platform, and provides a variety of investment and matching options for our employees."

Sarah Shimanek, CEO of Akasha Physiotherapy

NCFA with our strategic partner Betterment is very user friendly and their system is very smart. I also appreciate that their customer service is quick to answer and help (with a real human!)."

Katherine Scot, Human Resources of 5280 Floors

Sure, other providers can go very in-depth (to the point where not everything is clear at first glance), but Betterment can accomplish the same tasks in an efficient and easy-to-understand manner."

Daria Feneis, Manager of RocketReach

All-in pricing with no hidden fees.

Manage eligibility and coverage efficiently. We’re transparent about our fees and don’t hide future costs like some providers.

Control plan eligibility.

Decide who can participate or be excluded from your plan, like seasonal or part-time workers.

Automatic force outs.

Automatically remove terminated employees with low balances from your plan.

Fee flexibility.

Decide what employees pay for and what your business covers. Transfer certain plan expenses back to former employees.

Only pay for active participants.

Reduce fees by only paying for participants who fund their 401(k)s.